Your guide to spotting modern scams

Scammers are constantly evolving their tactics to trick you. From elaborate phishing emails to fake investment opportunities, the threats are diverse and ever-changing. Explore the latest scams and methods fraudsters use and learn how to safeguard your finances.

Digital danger zone

How scammers reach out

Scammers target their victims in multiple ways. Knowing how they contact you can help you learn where to be extra aware during your day-to-day interactions.

23%

21%

16%

14%

14%

12%

Quiz

Understanding social media scams

Think you know how to spot and avoid social media scams? Take this quiz to find out how to protect yourself from common fraud tactics.

a. 30% b. 44% c. 50% d. 60%

Scam alert

The new face of fraud targets your investments

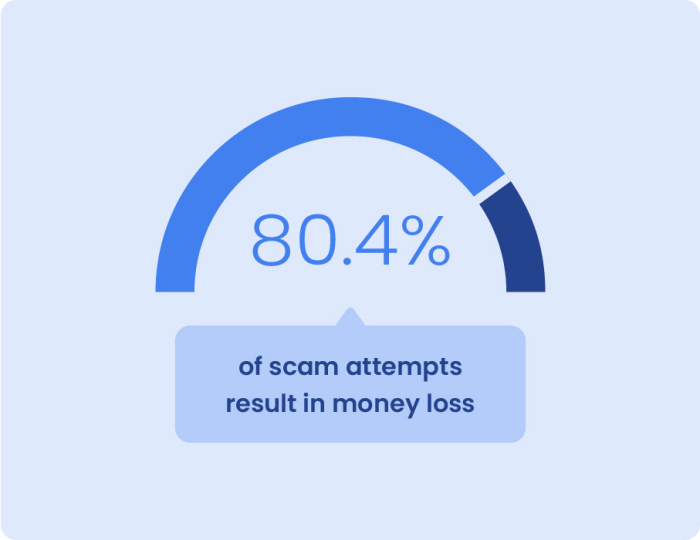

Investment and crypto scams have topped the risk list in recent years, with 80.4% of scam attempts resulting in money loss with a median loss of $3,800. Stay vigilant in your financial decisions to ward off these scammers.

Helpful hints for outwitting scammers

Protecting your finances starts with smart, everyday habits. Discover essential tips and tricks to help you bank safely and confidently, like enabling two-factor authentication and the importance of regular account monitoring. Understanding these practical strategies can help you build a robust defense against financial scammers.

Trendspotting

Rising fraud categories

Imposter scams are the leading fraud category

Scammers will impersonate financial institutions, government officials, distressed relatives, businesses or tech support to gain access to your sensitive information.

Losses from investment scams have been on the rise

These scams often promise high returns through lucrative opportunities like cryptocurrency.

Social media can be a hot spot for fraud

Scammers hack your profile to gain access to your personal information, impersonate you and con your contacts.

Key insights

Red flags that reveal banking imposter scams

Imposters will:

1

Real financial institutions never ask you to move money for any reason using transfers, gift cards or peer-to-peer payments.

2

Your financial institution will never ask you to repeat one-time verification codes over the phone.

3

Scammers pressure you to act quickly, while your financial institution will allow plenty of time for verification.

4

When in doubt, end the communication and call your financial institution directly.

Tools for your financial security

We're committed to helping you protect your finances, which is why we offer advanced security products and services designed to safeguard your accounts from fraud and scams. From real-time transaction alerts to secure authentication methods, we offer tools that put you in control. Learn how you can use these tools to bank with confidence.

Security features

How we keep your transactions secure

1

Automated systems monitor digital bill payments for suspicious activity, flagging and reviewing potential fraud.

2

A network of financial institutions anonymously shares fraud data to enhance detection, tracking consumer behaviors for signs of fraud.

3

Instantly verify external accounts, ensuring secure account-to-account transfers.

4

Ensures fast and safe transactions with real-time data enrichment to enhance fraud detection accuracy.*

5

Adaptable risk management strategies evolve with changing fraud patterns to maintain security standards.

Zelle® banking safety

Remember, if the recipient

is enrolled, payments

can’t be canceled,

U.S. checking or savings account required to use Zelle®.

Transactions between enrolled uers typically occur in minutes.

Safety tip

Keep your accounts safe by setting up banking alerts

Setting up alerts on your accounts can help you stay informed in real-time about suspicious activity on your account, like unexpected withdrawals or large purchases.

Frequently asked questions and helpful links

Discover the answers to common questions about banking safety and explore links to resources that can help you in the event of a fraud attempt.

FAQ

Q: How do I recover after a cyberattack?

A: If you've provided your financial information to someone you later think is a scammer, first call your financial institution. Whether it's your credit card issuer, financial institution or Medicare contact, call and ask about canceling fraudulent transactions and blocking future charges. You might also need to change your account numbers and freeze your credit to make sure no one uses your existing accounts or creates new accounts in your name.

Q: What if my personal email account, bank account or other accounts were compromised?

A:

- Immediately change your passwords for any potentially compromised accounts.

- Contact your financial institution to let them know your accounts may be compromised. Ask them to put a fraud alert on your accounts.

- Check your financial statements and credit reports to regularly identify any false charges or suspicious activity.

Q: What should I do if I suspect my identity has been stolen?

A: Check your credit card, financial institution and other financial accounts for unauthorized charges or changes. If you see any, report them to the company or institution. Then go to IdentityTheft.gov to see what steps you should take.

Resource links

Helpful resources

Banner’s Card Fraud Department

We may be calling you.

To protect your account, we monitor your ATM and debit card transactions for potentially fraudulent activity which may include a sudden change in locale (such as when a U.S.-issued card is used unexpectedly overseas), a sudden string of costly purchases, or any pattern associated with new fraud trends around the world.

- Our automated call will ask you to verify recent transaction activity on your card

- You’ll be able to respond via your touchtone keypad

- You’ll also be provided a toll-free number to call should you have additional questions

Our goal is to minimize your exposure to risk and the impact of any fraud. To ensure we can continue to reach you whenever potential fraud is detected, please keep us informed of your correct phone number and address at all times. We will NEVER ask for your personal or account information. We will only ask you to verify transactions.

Protect Yourself

In the meantime, please be diligent in monitoring transaction activity on your account and contact us immediately if you identify any fraudulent transactions. Here are some additional tips on protecting yourself from debit card fraud. Unless absolutely required for a legitimate business purpose, avoid giving out your:

- Address and ZIP code

- Phone number

- Date of birth

- Social Security number

- Card or account number

- Card expiration date

How to Report Fraud if it Happens

If you suspect you have been exposed to suspicious activity or fallen victim to fraud or identity theft, you should take action immediately using the steps below.

Report the incident to us:

Banner VISA Credit Card call 1-800-558-3424.

Banner VISA Debit Card or ATM Card call 1-800-617-3775

- Report to the incident to your other financial institution.

- Call your credit card companies

- Set up credit report and fraud monitoring

If you have a Banner Federal checking account you already have credit report monitoring and fraud alerts for FREE as part of your services with us through ID Protect Me.

You may also contact the Internet Crime Complaint Center, a partnership between the Federal Bureau of Investigation and the National White Collar Crime Center.

NCUA operates an online Fraud Prevention Center that offers information about avoiding frauds and scams on its MyCreditUnion.gov website.

Additional actions that may be appropriate depending on the circumstances: